Navigating Today’s Housing Market: The Benefits of Co-Buying a Home

Real Estate

Real Estate

In today’s challenging real estate environment, aspiring homeowners often feel overwhelmed by rising home prices and climbing mortgage rates. Many potential buyers are left grappling with affordability issues, making it seem like owning a home is just out of reach. However, there’s a growing trend that might just be the solution: co-buying a home. As highlighted by Freddie Mac, “If you are an aspiring homeowner, buying a home with your family or friends could be an option.”

This article explores what co-buying entails and why it’s becoming increasingly popular, along with crucial considerations for prospective co-buyers.

Co-buying is the process of purchasing a home jointly with someone else, be it a friend, family member, or even a group of individuals. With today’s steep housing prices and interest rates, this approach has gained traction. According to a survey by JW Surety Bonds, almost 15% of Americans have already co-purchased a home, with an additional 48% open to the idea.

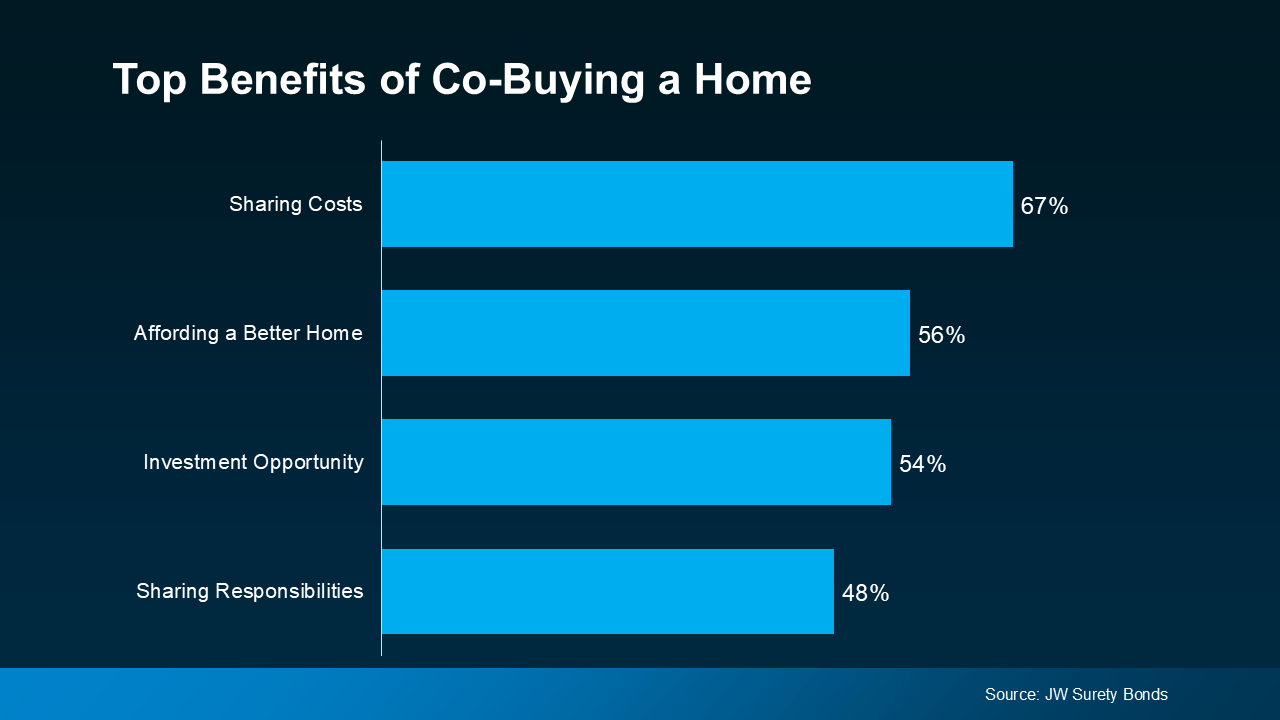

As highlighted in the survey above, numerous benefits come with co-buying a home. Here are some standout advantages:

1. Sharing Costs (67%)

Owning a home involves significant financial commitments—from down payments to monthly mortgage payments. Co-buying can alleviate this burden by allowing multiple parties to split costs, making homeownership more attainable.

2. Affording a Better Home (56%)

Pooling financial resources enables co-buyers to afford a larger or better-quality home than they would individually. Whether it's an extra bedroom, a spacious yard, or a more desirable location, co-buying can provide options that fit your lifestyle.

3. Investment Opportunity (54%)

Co-buying isn’t just about living; it’s also about investing. Purchasing property with others presents the opportunity to rent out part of the home or the entire property, thus creating a source of passive income.

4. Sharing Responsibilities (48%)

Homeownership comes with a vast array of responsibilities—maintenance, upkeep, property management, and more. Co-buying allows you to share these obligations, making homeownership more manageable.

While co-buying offers numerous benefits, it’s crucial to carefully consider several factors before taking the plunge. As Rocket Mortgage advises, **“Buying a house with a friend or multiple friends might be a great way for you to achieve homeownership, but it’s not a decision you should make lightly.”** Understanding the financial, logistical, and emotional elements involved is essential. Here are some considerations:

Communication: Ensure all parties are aligned on financial contributions, upkeep responsibilities, and plans for future sell-offs. Open dialogue can prevent misunderstandings.

Legal Agreements: Drawing up a legal agreement can clarify obligations and protections for all parties involved. This could include what happens if someone wishes to sell their share of the property.

Financial Assessment: Each buyer should assess their financial situation to make sure they can handle the responsibilities of homeownership together.

If you’re struggling with today’s affordability challenges, co-buying may be the key to achieving your dream of homeownership. By sharing costs and responsibilities, you can make a strategic move into the housing market. However, thorough planning and clear communication among all parties are essential to ensuring a smooth and successful co-buying experience.

Ready to explore if co-buying makes sense for you? Let’s connect! Together, we can navigate your options and make informed decisions about homeownership in today’s market.

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.