The 20% Down Payment Myth, Debunked: Your Path to Homeownership Might Be Easier Than You Think

Saving up to buy a home can feel a little intimidating, especially right now. Between rising prices and general economic uncertainty, the idea of accumulating a hefty down payment can feel like a major roadblock for many aspiring homeowners. And for a long time, the common wisdom has been that you absolutely must put 20% down to buy a house.

But guess what? That’s actually a common misconception – a myth that might be holding you back from your dream of homeownership. Here’s the truth.

Unless your specific loan type or lender explicitly requires it, odds are you won’t have to put 20% down. This is one of the biggest myths in real estate! There are numerous loan options out there specifically designed to help first-time buyers like you get in the door with a much smaller down payment.

For example:

So, while putting down more money certainly has its benefits (like potentially lower monthly payments and avoiding private mortgage insurance), it's absolutely not essential to get into a home. As The Mortgage Reports aptly puts it:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

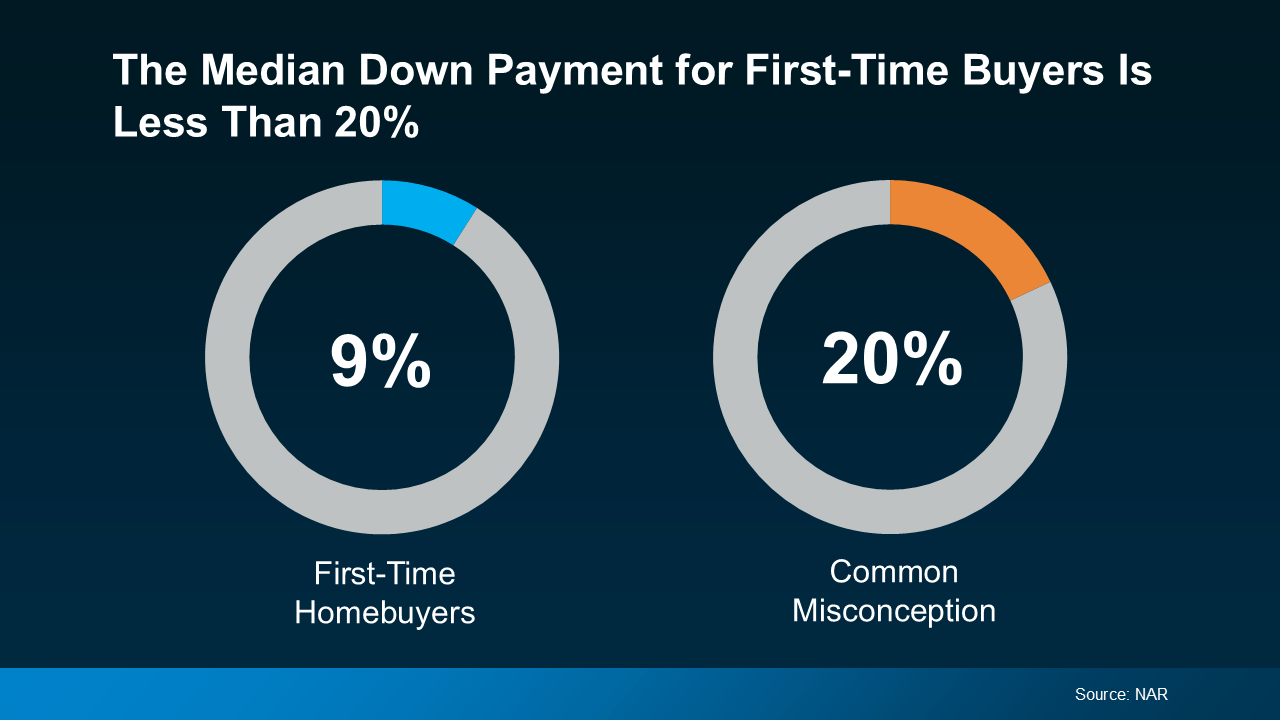

According to the National Association of Realtors (NAR), the reality for first-time homebuyers is far from a 20% requirement. Their data shows the median down payment for this group is significantly lower, sitting at just 9% (see the chart below).

The key takeaway? You may not need to save as much as you originally thought to become a homeowner. This realization can significantly shorten your timeline and make the goal feel much more achievable.

And the best part is, there are also a lot of programs out there designed to give your down payment savings a significant boost. These are resources that many potential buyers aren't even aware are an option.

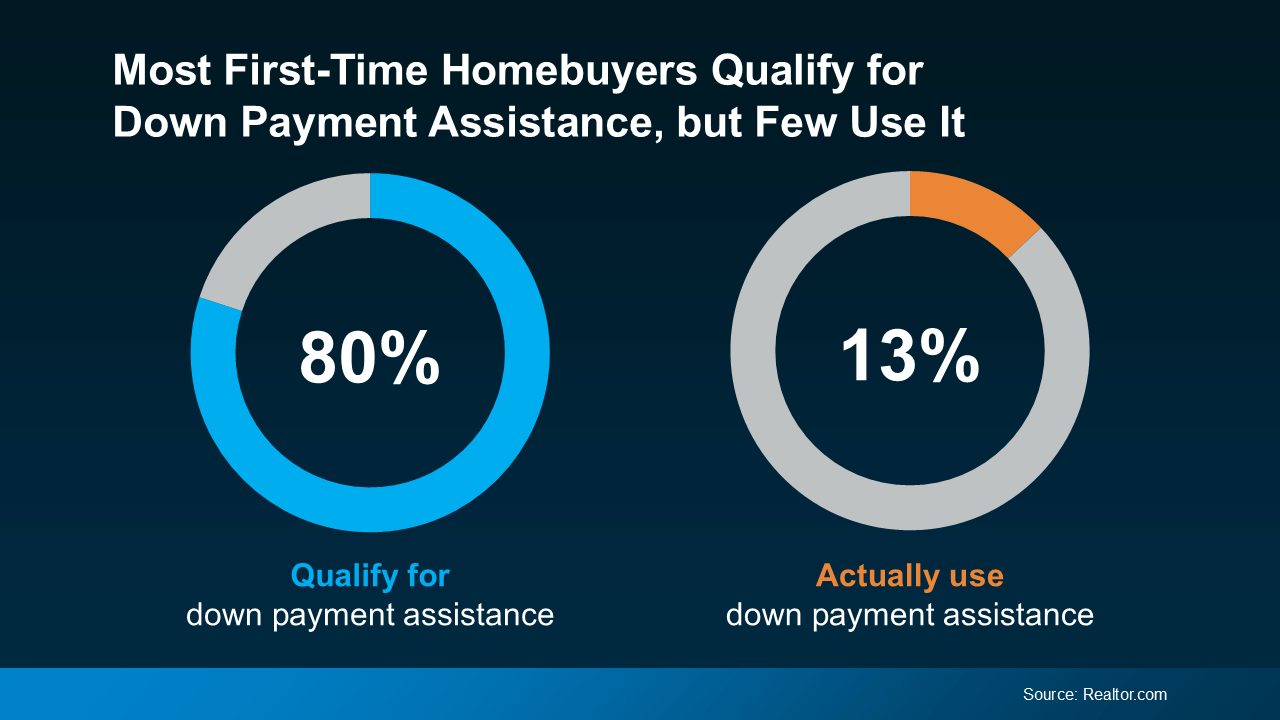

This is where things get really interesting. Believe it or not, almost 80% of first-time homebuyers actually qualify for some form of down payment assistance (DPA), but a surprisingly low 13% actually utilize it (see the chart below).

That’s a staggering amount of missed opportunity! These programs aren't small-scale help, either. Many offer thousands of dollars that can go directly toward your down payment and closing costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine how much further your homebuying savings would go if you were able to qualify for $17,000 worth of help. For many, this could mean the difference between waiting years and buying a home much sooner. In some cases, you may even be able to stack multiple programs at once, giving what you’ve saved an even bigger lift. These are the type of benefits you absolutely do not want to leave on the table when you're trying to achieve homeownership.

Saving up for your first home can feel like a monumental task, especially if you're still operating under the outdated assumption that you have to put 20% down. The truth is, that's a common myth that doesn't reflect the reality of today's mortgage market.

Many loan options require much less upfront, and there are even fantastic programs out there designed to boost your savings and make homeownership more accessible than you might think.

To learn more about what’s available in your area and if you’d qualify for any down payment assistance programs, the best next step is to talk to a trusted and experienced lender. They can help you navigate the options and find the right path to your first home.

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.