Take Advantage of Declining Mortgage Rates: Your Guide to Buying a Home

If you've been hesitant to purchase a home due to high mortgage rates, now may be the perfect time to reconsider your options. Recent trends indicate that mortgage rates have been steadily declining, providing you with a valuable opportunity to jump back into the housing market.

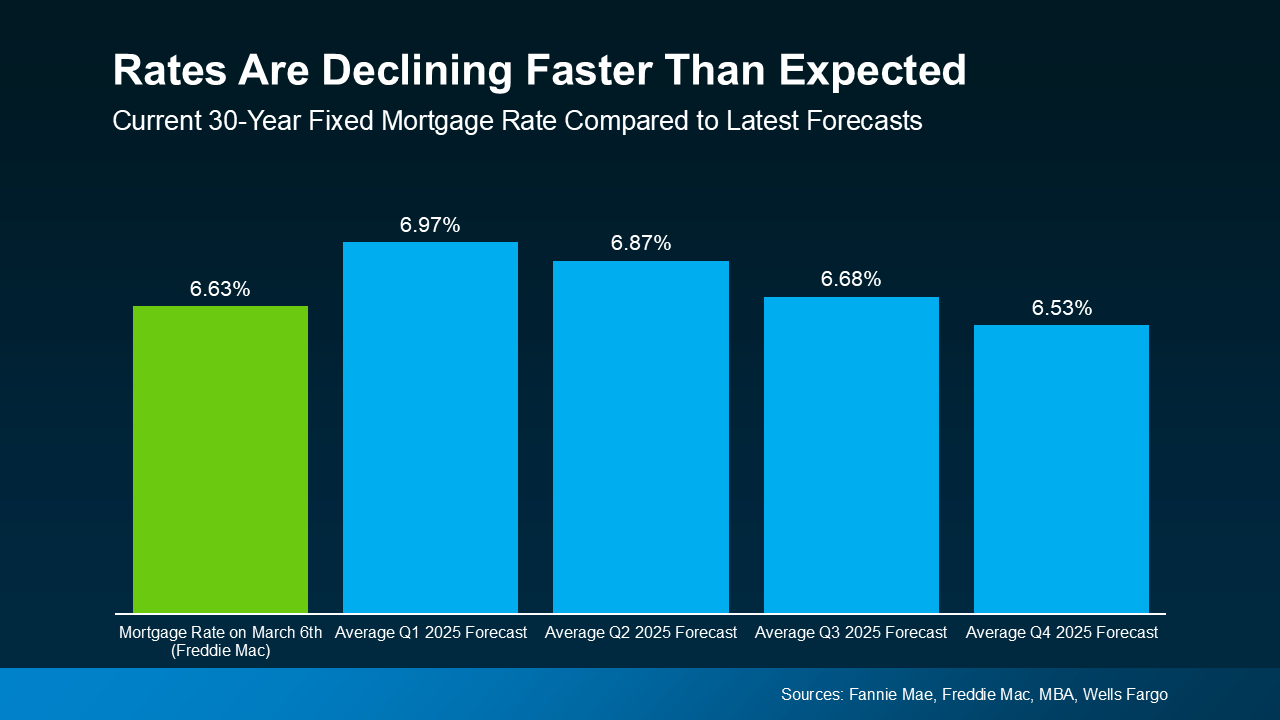

According to Freddie Mac, mortgage rates have fallen for seven consecutive weeks, reaching the lowest levels seen so far this year. The average weekly rate has dropped from over 7% to the mid-6% range, a shift that can significantly impact your home-buying decision—especially since forecasts predicted this drop would not occur until the latter half of the year.

Mortgage rates have recently benefitted from a mix of factors, as noted by Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA). Economic uncertainty and changes in consumer sentiment, along with potential impacts from new tariffs on imports, have contributed to this decline. Kan pointed out that last week witnessed the largest drop in the 30-year fixed mortgage rate since November 2024, marking a pivotal moment for potential homebuyers.

As we approach the spring real estate market, this decline in mortgage rates comes as a welcome relief for many buyers. However, it's essential to keep in mind that mortgage rates can fluctuate rapidly, so it's vital to take advantage of the current trend while you can.

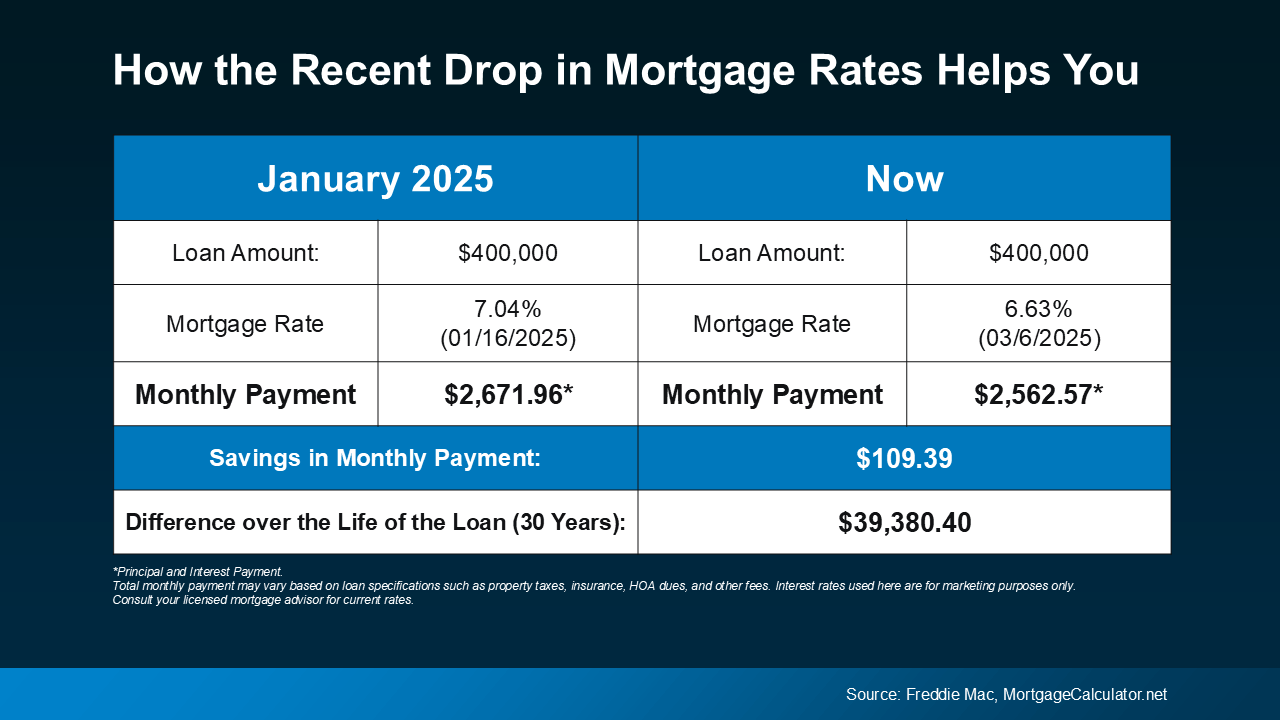

Even minor shifts in mortgage rates can impact your monthly mortgage payments significantly. To put this into perspective, let’s consider a scenario involving a $400,000 home loan.

Previously, at a 7.04% interest rate, your monthly payment (principal and interest) was substantially higher compared to what you would pay with the current rates in the mid-6% range. In fact, the anticipated monthly payment could decrease by over $100, resulting in considerable savings over the life of the loan.

If you've been waiting for mortgage rates to dip before buying a home, that moment may have arrived. However, the rapidly changing economic landscape means that rates could become volatile again soon. Don’t miss out on this window of opportunity if you're ready to take the plunge into homeownership.

With mortgage rates currently on the decline, now is an excellent time for potential buyers to explore their options. If a lower monthly payment makes purchasing a home feel more achievable for you, don’t hesitate to reach out. Let’s break down the numbers together and find the best path for your home-buying journey.

Are you ready to take advantage of the declining mortgage rates and make your dream home a reality? Contact us today to learn more about your options and how we can help you navigate the home-buying process!

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.