Understanding Mortgage Rate Volatility and How to Prepare for Homeownership

Have you noticed the erratic fluctuations in mortgage rates lately? One day they dip slightly, and the next, they surge again. Navigating these ups and downs can feel disheartening, especially for potential homebuyers pondering whether now is the ideal time to make a purchase.

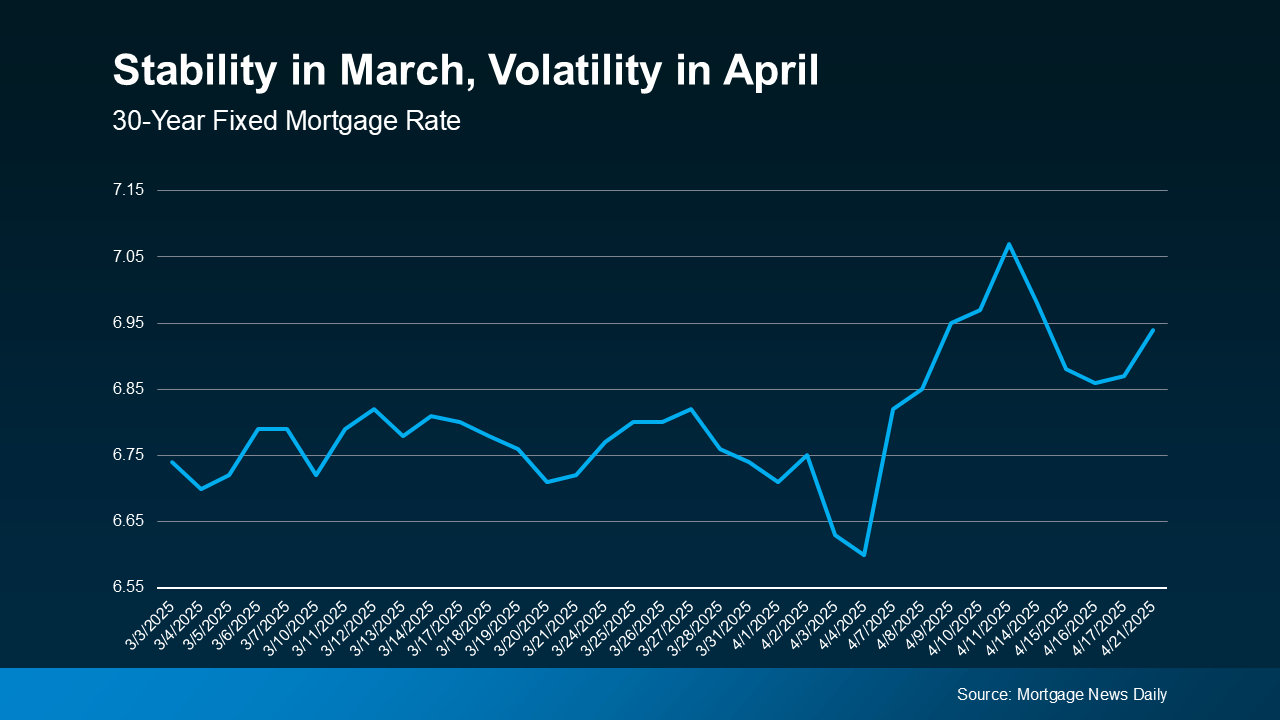

Mortgage rates have experienced significant variability, particularly observed in a recent analysis using data from Mortgage News Daily. After a relatively stable March, April has presented a wild roller coaster ride of rates. While the shifts may seem puzzling, they are typical during times of economic change. The current climate underscores an essential truth: attempting to time the market may not be the best strategy.

While the economy and mortgage rates are outside our direct control, there are several aspects of your financial profile that you can manage to improve your chances of securing a favorable mortgage rate. Here’s what you can control:

Your credit score is one of the most pivotal factors lenders consider when you apply for a mortgage. A higher score usually translates to better interest rates and loan terms. According to Bankrate, “Your credit score is not only crucial for qualifying for a loan but also for the conditions attached to it.”

Pro tip: Check your credit score regularly and take proactive steps to improve it. Small adjustments, like paying down credit card balances or ensuring timely bill payments, can significantly impact your financial bottom line. If you're uncertain about your current credit standing, consult with a trustworthy loan officer for guidance.

Understanding various loan types is equally essential, as different loans come with unique conditions and qualifications. The Consumer Financial Protection Bureau (CFPB) explains, "There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans.”

What can you do? Speak to multiple lenders to explore the best loan options for your specific situation. A knowledgeable mortgage professional can help you navigate your choices to find the most beneficial product for your needs.

Loan terms dictate the duration you have to repay your mortgage, impacting your interest rate and monthly payments. As Freddie Mac explains, “Your loan term will influence your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Important to consider: Common terms include 15, 20, or 30 years, each offering distinct financial ramifications. Discuss with your loan officer to determine which option fits best with your long-term financial plan.

While we cannot dictate the trajectory of the economy or mortgage rates, we can adopt strategies to secure the best possible mortgage when the time is right. By maintaining a strong credit score, understanding various loan options, and selecting the appropriate loan term, you enhance your financial position for homeownership.

Are you interested in learning more about how to navigate the current real estate market? Don’t hesitate to reach out! I’m here to provide insights and strategies tailored to your unique situation so you can confidently prepare for your journey into homeownership.

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.