Unlocking the Joy of Retirement: Is Your Home Helping or Hindering Your Dreams?

Retirement isn’t just a life milestone; it’s the exciting dawn of a new adventure! After decades of dedication and hard work, it’s your time to slow down, uncover new passions, and embrace a lifestyle where you call the shots. However, with this newfound freedom comes crucial decisions—like whether your current home aligns with your vision for this next thrilling chapter.

Is Your Home Still a Good Fit for Retirement?

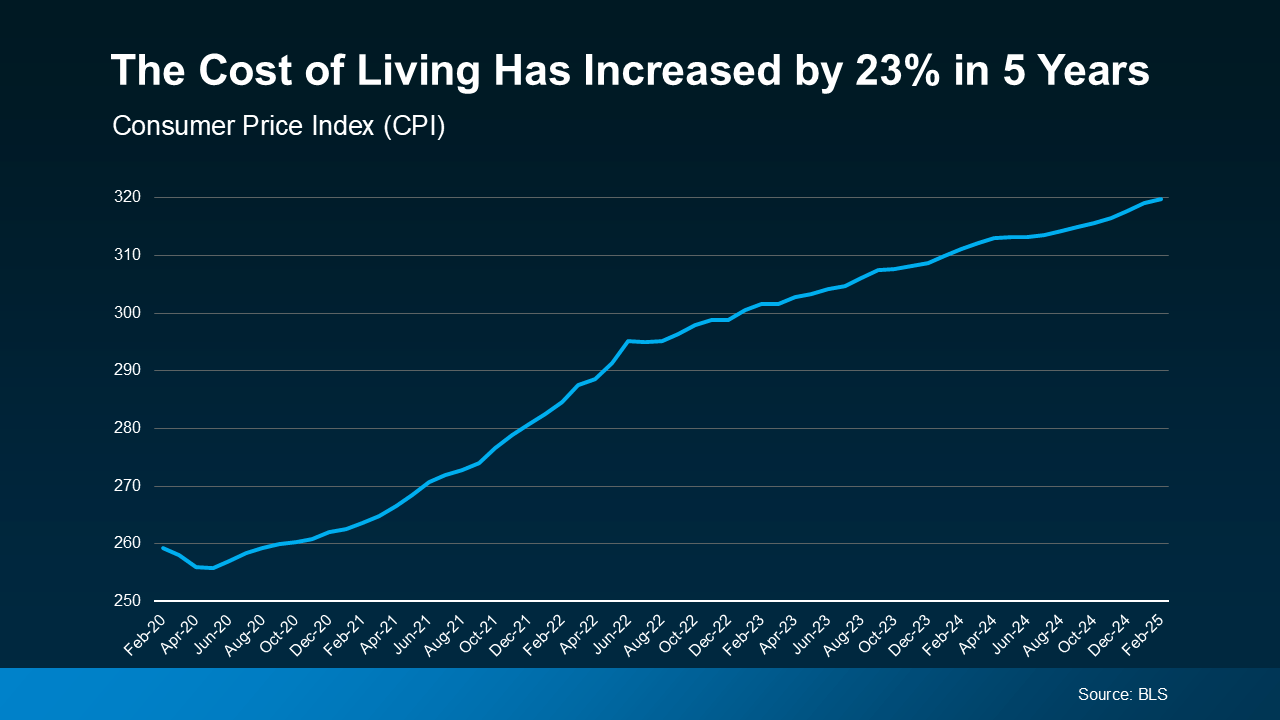

As you contemplate your golden years, asking the right questions is vital. Does your current residence support the lifestyle you desire, both in terms of living arrangements and financial viability? This question is more pressing now than ever; according to the Bureau of Labor Statistics (BLS), the cost of living has surged by a staggering 23% in just the past five years! This trend means watching your expenses closely is essential for stretching your retirement savings.

Make Your Savings Last by Relocating

If you’re beginning to worry about whether your retirement funds will meet your needs, worry not! Many retirees are taking control of their financial futures by relocating. By choosing a location with a lower cost of living, you can see significant savings on essential expenses like housing, utilities, and taxes—especially if downsizing is part of your plan.

Imagine having extra cash in your budget to indulge in life’s pleasures: traveling to dream destinations, engaging in new hobbies, or showering your grandkids with love and attention. That’s what retirement is all about—living life to the fullest!

Think Local: The Importance of Where You Live

While relocating out of state can be appealing, sometimes the best move is a bit closer to home. Transitioning to the suburbs or finding a cozy spot in a neighboring town can greatly impact your finances—allowing you to enjoy your savings while remaining close to family and friends.

As Go Banking Rates puts it: “How much you should have saved for retirement depends on a few key factors, including your location.” Choosing the right place to spend your golden years is crucial for a fulfilling retirement.

Navigating Your Next Move with Expert Help

Whether you’re downsizing to simplify your life, moving closer to your loved ones, or seeking a location where your savings stretch further, working with a trusted real estate agent can make all the difference. They’ll help you explore opportunities that match your retirement dreams, making the selling process of your current home smoother and connecting you with reputable agents in your new desired locales.

Final Thoughts: Shape the Retirement You Deserve

You’ve dedicated years to building a future that empowers you to enjoy life. If your current home isn’t part of that vision, it might be time to explore your options.

What does your ideal retirement look like? Could a move enhance your enjoyment of this wonderful chapter of life? Let’s discuss turning your dream retirement into reality—together, we can navigate this exciting journey!

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.