Will Mortgage Rates Decrease? Explore Smart Financing Options for Homebuyers

Real Estate

Real Estate

Many prospective homebuyers are holding their breath, hoping that mortgage rates will decrease significantly before making a purchase. However, as we look at the latest forecasts, the reality may not align with these optimistic expectations. While experts suggest that rates will decline somewhat, the anticipated dip isn’t as substantial as many would like it to be.

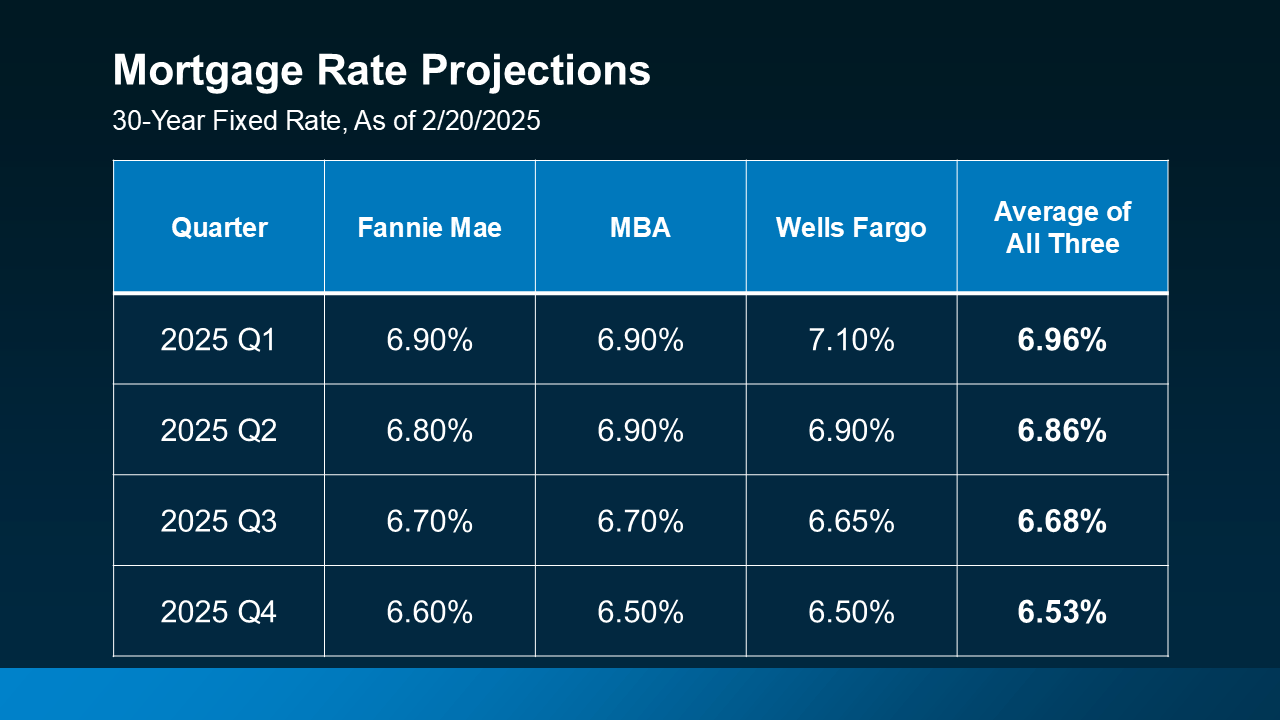

Just a few months ago, the outlook was brighter, with some projections hinting at mortgage rates dipping below 6% by year's end. However, recent updates from industry leaders such as Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo have adjusted this outlook, indicating that mortgage rates are likely to stabilize closer to the 6.5% to 7% range.

If you're holding off on buying a home because of the hope for a more significant decline in mortgage rates, you might find yourself waiting longer than anticipated. Life circumstances, whether it’s a new job, the arrival of a new baby, or a marriage, may require you to take action sooner rather than later.

Given that rates aren’t expected to fall as much as initially hoped, exploring alternative financing options could help you secure your dream home sooner. Here are three creative strategies to discuss with your lender:

Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to lower your mortgage rate for a specified period. This strategy can be beneficial if you’re looking for lower monthly payments early in your mortgage term. According to recent reports, about 27% of agents note that first-time homebuyers are increasingly requesting buydowns from sellers.

Adjustable-Rate Mortgages (ARMs)

ARMs start with a lower interest rate than traditional fixed-rate mortgages, making them attractive for buyers speculating that rates may drop in the future or who plan to refinance later. Importantly, today’s ARMs are significantly different from those offered during the housing crash of the mid-2000s. Current ARMs require lenders to ensure borrowers can handle payments based on higher market rates rather than just the initial lower rates.

Assumable Mortgages

An assumable mortgage lets you take over the seller’s existing loan, including any favorable lower rate they may have secured. With a reported 11 million homes qualifying for this type of mortgage, it’s worth investigating if you’re seeking better financing conditions.

Rather than waiting for a drastic decrease in mortgage rates, consider taking action with options like buydowns, ARMs, or assumable mortgages that could make homeownership more attainable for you today. Connect with a local lender to discuss which strategies best suit your financial situation and homebuying goals.

How does this evolving landscape influence your homebuying plans this year?

12600 Hill Country Blvd Ste R130 #5067,

Bee Cave, TX 78738

Stay up to date on the latest real estate trends.

Learn how to define your budget and needs, navigate the 2025 market, and secure the perfect property with a local expert.

Real Estate

Think you need 20% down to buy a house? Think again! Click to read more

Kathy Anglin has worked in the real estate industry since 1995 and has amassed a renowned class of clientele and unmatched experience.